Software Developer (Low Code)

Role details

Job location

Tech stack

Job description

Discover a career in your hands at HMRC. Whether you're seeking purpose, growth, or a workplace that gives you a true sense of belonging, hear from some of our employees as they share their story about what it's really like to work at HMRC.

Visit our YouTube channel to watch the full series and come and discover your potential.

At HMRC we are committed to creating a great place to work for all our colleagues; an inclusive and respectful environment that reflects the diversity of the society we serve.

We want to maximise the potential of everyone who chooses to work for us, and we offer a range of flexible working patterns and support to make a fulfilling career at HMRC accessible to you. Diverse perspectives and experiences are critical to our success, and we welcome applications from all people from all backgrounds with the experience and skills needed to perform this role.

The Borders and Trade Delivery Group are responsible for the end-to-end service management and development of over 140 separate services from the generation of Trade Statistics to the administration of Customs and Excise duties.

This role is within the Development Guild in the Chief Data and Information Office (CDIO), working across projects supporting Borders and Trade (B&T). It is an exciting and challenging role for those looking to deliver and inform technological change against a background of organisational transformation, working with the Head of Development in Digital Platforms.

Do you want to make a difference? Come and join us., As a Developer, you'll work within a delivery team to build reliable, maintainable digital services on HMRC's Multi-channel Digital Tax Platform. You'll follow Agile and DevOps practices, using test-driven development and collaborating closely with senior developers. You'll also contribute to the technical community by sharing best practices and participating in events and academy sessions.

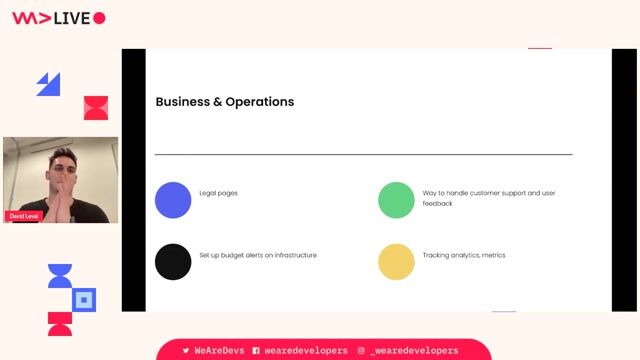

The role of a low-code Developer in CDIO Borders & Trade Engineering, helps to develop and support new Borders applications (e.g., VIES and TIGS/TS93) using technologies like PowerPlatform. Using your knowledge of source code control and CI/CD tools (e.g. Git, Jenkins etc) you'll work with stakeholders across the IT lifecycle to ensure solutions meet user needs.

Person specification

Role responsibilities can include any or all the following disciplines across the full range of duties:

- Combining UI driven logic with scripts and code to solve complex problems.

- Proposing, designing, and building complex program solutions from supplied requirement specifications.

- Understanding and utilising the services available within relevant low-code platforms.

- Collaborating with other stakeholders in reviewing supplied requirement specifications.

- Managing competing priorities and documenting deliverables in accordance with agreed standards.

- Designing, implementing, and operating controls and management strategies to maintain the security, confidentiality, and integrity of information systems.

- Reporting task outcomes to stakeholders in a clear and concise manner.

- Support and maintenance of live services developed on legacy and/or modern technologies.

- Planning, designing, and conducting tests of programs to deliver error-free systems.

- Coaching, mentoring and line management of junior colleagues.

- Candidates will either have SC level security clearance or be willing to undertake such., We want to make sure no one is put at a disadvantage during our recruitment process. To assist you with this, we will reduce or remove any barriers where possible and provide additional support where appropriate., HMRC has a presence in every region of the UK. For more information on where you might be working, review this information on our locations.

The Civil Service values honesty and integrity and expects all candidates to abide by these principles. The evidence you provide in your application must relate to your own experiences.

Any instances of plagiarism or other forms of cheating will be investigated and, if proven, the relevant application(s) will be withdrawn from the process.

Recording of interviews is prohibited unless explicit agreement is sought in line with the UK General Data Protection Regulations.

Questions relating to an individual application must be emailed as detailed later in this advert.

Applicants who are successful at interview will be, as part of pre-employment screening, subject to a check on the Internal Fraud Database (IFD). This check will provide information about employees who have been dismissed for fraud or dishonesty offences. This check also applies to employees who resign or otherwise leave before being dismissed for fraud or dishonesty had their employment continued. Any applicant's details held on the IFD will be refused employment.

A candidate is not eligible to apply for a role within the Civil Service if the application is made within a 5 year period following a dismissal for carrying out internal fraud against government.

New entrants will join on the minimum of the pay band.

Please note that, if you are applying for roles on a part-time basis, the salary agreed will be pro-rata, reflective of the working hours agreed within your contract.

If you experience accessibility problems with any attachments on this advert, please contact the email address in the 'Contact point for applicants' section.

For more Information for people applying for, or thinking of applying for, roles at HM Revenue and Customs, please see link: Working for HMRC: information for applicants - GOV.UK. Feedback will only be provided if you attend an interview or assessment.

Security

Successful candidates must undergo a criminal record check. Successful candidates must meet the security requirements before they can be appointed. The level of security needed is security check .

See our vetting charter . People working with government assets must complete baseline personnel security standard (opens in new window) checks., * UK nationals

- nationals of the Republic of Ireland

- nationals of Commonwealth countries who have the right to work in the UK

- nationals of the EU, Switzerland, Norway, Iceland or Liechtenstein and family members of those nationalities with settled or pre-settled status under the European Union Settlement Scheme (EUSS)

- nationals of the EU, Switzerland, Norway, Iceland or Liechtenstein and family members of those nationalities who have made a valid application for settled or pre-settled status under the European Union Settlement Scheme (EUSS)

- individuals with limited leave to remain or indefinite leave to remain who were eligible to apply for EUSS on or before 31 December 2020

- Turkish nationals, and certain family members of Turkish nationals, who have accrued the right to work in the Civil Service, Appointment to the Civil Service is governed by the Civil Service Commission's Recruitment Principles. You have the right to complain if you feel there has been a breach of the Recruitment Principles. In the first instance, you should raise the matter directly via ubsrecruitmentcomplaints@hmrc.gov.uk. Please note that we do not accept complaints or appeals regarding scoring of outcomes of campaigns, unless candidates can provide clear evidence that the campaign did not follow the Recruitment Principles. If you are not satisfied with the response, you may bring your complaint to the Commission. For further information on bringing a complaint to the Civil Service Commission please visit their website.

Requirements

Do you have experience in Test-driven development?, You must be able to demonstrate experience and knowledge of:

- Able to produce detailed designs: analyse and decompose a programming problem, choosing appropriate techniques to solve each part.

- Ability to write clean, re-useable, secure code following best practice, standard and principles - utilising Source Code Control and CI/CD tools (e.g. Git, Jenkins etc)

- Good understanding of software development methodologies (e.g. Agile, Waterfall etc).

- Ability to resolve software problems and incidents following playbooks and agreed maintenance procedures.

- Ability to communicate technical concepts to a non-technical audience.

- Ability and willingness to learn and embrace emerging IT technologies and techniques.

Desirable Criteria:

It is desirable for you to demonstrate experience of:

- Experience of supporting and maintaining software in a live environment.

- Knowledge of the C# programming language at practitioner level., Customer facing roles in HMRC require the ability to converse at ease with members of the public and provide advice in accurate spoken English and/or Welsh where required. Where this is an essential requirement, this will be tested as part of the selection process.

Benefits & conditions

Alongside your salary of £37,682, HM Revenue and Customs contributes £10,916 towards you being a member of the Civil Service Defined Benefit Pension scheme. Find out what benefits a Civil Service Pension provides.

HMRC operates both Flexible and Hybrid Working policies, allowing you to balance your work and personal commitments. We welcome applications from those who need to work a more flexible arrangement and will agree to requests where possible, considering our operational and customer service needs.

We offer a generous leave allowance, starting at 25 days and increasing by a day for every year of qualifying service up to a maximum of 30 days.

- Pension - We make contributions to our colleagues' Alpha pension equal to at least 28.97% of their salary.

- Family friendly policies.

- Personal support.

- Coaching and development.

To find out more about HMRC benefits and find out what it's really like to work for HMRC hear from our insiders or visit Thinking of joining the Civil Service