Rust Quant Developer - Trading Systems - Major Hedge Fund

(capital Markets)

12 days ago

Role details

Contract type

Permanent contract Employment type

Full-time (> 32 hours) Working hours

Regular working hours Languages

English Experience level

Intermediate Compensation

£ 66KJob location

Tech stack

Algorithmic Trading

Financial Software

Python

Machine Learning

SQL Databases

Linux Development

Information Technology

Job description

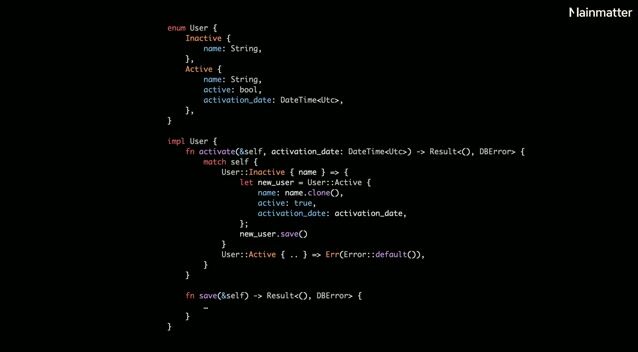

- Collaborate with a team of talented traders and quant developers to help build out a real-time trading platform / execution system using Rust and Python

- Work closely with Quant Researchers and Traders to optimise trading strategies

- Develop high quality Machine Learning pipelines, market data and analytics systems

Requirements

- Minimum of 2 - 4 years of hands-on experience with Rust and Python

- 3+ years of financial software engineering experience

- Previous buyside experience

- Strong Linux development and SQL skillset

- BS in Computer Science, Engineering, or related quantitative discipline

- CQF certification is a bonus

About the company

Our client, a major Quantitative Hedge fund, is looking to hire a Rust Software Engineer / Quantitative Developer to help develop a new systematic trading platform.

This is a greenfield project and is a fantastic opportunity to be exposed to all aspects of the quantitative trading business.

This role gives you the opportunity to join one of the world's most successful trading firms, collaborate with an exceptionally talented team operating in a hybrid approach, and earn market-leading compensation packages.