Quantitative Developer

Role details

Job location

Tech stack

Job description

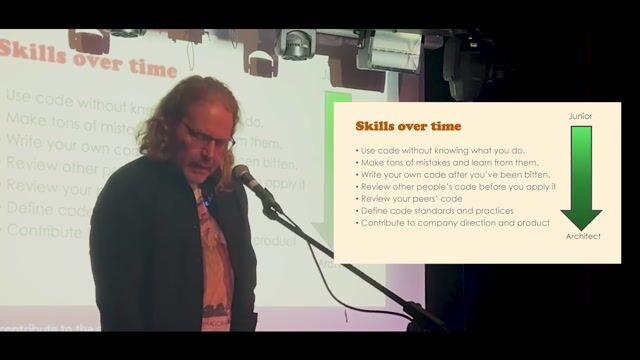

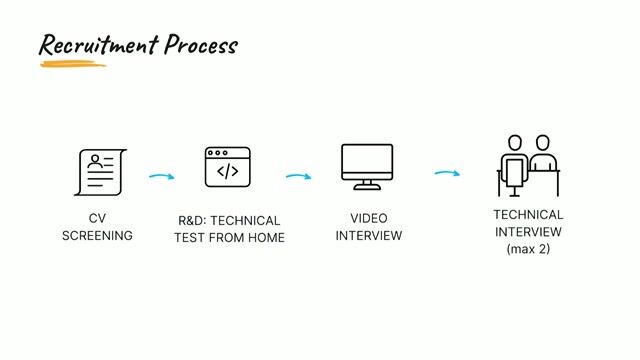

The Role We seek an exceptional person to join our Execution GRC team in an individual contributor role. The candidate's primary focus will be to Build anomaly detection and prediction models to aid ongoing due diligence on the firm's investment teams and trade flow. Assist in building real-time surveillance infrastructure implementing these models. The team will work closely with portfolio managers, compliance specialists, technologists and the sell-side to design and operate a comprehensive program. What you'll do The successful candidate will help design and implement systematic and quantitative models for execution governance and risk mitigation. They will build and extend an autonomous surveillance platform across the organization's global footprint to support 24x6 real-time coverage. They will engage with multiple teams within the firm to build rigorous software to measure and analyze trade flow and other metrics. Finally, they will back up frontline support teams for incident, DEI initiatives here - Belonging @ Schonfeld. Who we are Schonfeld Strategic Advisors is a multi-manager platform that invests its capital with Internal and Partner portfolio managers, primarily on an exclusive or semi-exclusive basis, across four trading strategies; quantitative, fundamental equity, tactical trading and discretionary macro & fixed income. We have created a unique structure to provide global portfolio managers with autonomy, flexibility and support to best enable them to maximize the value of their businesses. Over the last 30 years, Schonfeld has successfully capitalized on inefficiencies and opportunities within the markets. We have developed and invested heavily in proprietary technology, infrastructure and risk analytics and continue to capitalize on new opportunities. In 2021 we launched our newest strategy, discretionary macro & fixed income as part of the continual growth of Schonfeld's investible universe. Our portfolio exposure has expanded across the Americas, Europe and Asia as well as multiple asset classes and products. #LI-TJ1 Responsibilities The successful candidate will design and implement systematic and quantitative models for execution governance and risk mitigation. They will build and extend an autonomous surveillance platform to support real-time coverage across the organization.

Requirements

Python, Quantitative Modelling, SQL, Statistical Methods, Communication Skills, Collaboration, Anomaly Detection, Predictive Analytics, Equities Trading, Derivatives Trading, Market Microstructure, Execution Algorithms, DMA Strategies, response and escalation and develop infrastructure to automate response protocols. What you'll bring What you need: Minimum bachelor's degree, ideally in computer science, mathematics or other STEM discipline Minimum two years' experience in a quantitative developer role. Strong programming ability in Python, particularly for quantitative modelling, e.g., familiarity with pandas/polars, scikit-learn, parquet etc. Experience with SQL and relational databases, e.g., PostgreSQL. Ability to solve technical problems using statistical and computational methods. Excellent communication skills and ability to collaborate well with others. We'd love if you had: Experience with anomaly detection techniques, and predictive analytics Knowledge of equities and derivatives trading, market microstructure, and electronic markets Experience with execution algorithms or DMA quantitative trading strategies Our Culture The firm's ethos is embedded in our people. 'Talent is our strategy' is our mantra and