Python Quantitative Developer - Portfolio Construction

Role details

Job location

Tech stack

Job description

CFM is seeking a dynamic quantitative Developer to join our Portfolio team. This team focuses on constructing and monitoring portfolios in production and back testing environments across various asset classes, including stocks, futures, and options.

Based in Paris, you will work alongside experienced engineers to enhance portfolio construction processes., * Collaborate with quant research teams to model and build core portfolio construction features and integrate new ideas into production.

- Design and enhance back-testing frameworks to validate strategies/new ideas and assess their performance.

- Build essential tools to support quant researchers in advancing innovative portfolio construction methodologies.

- Participate in the support of decision-making processes in production and back-testing environments.

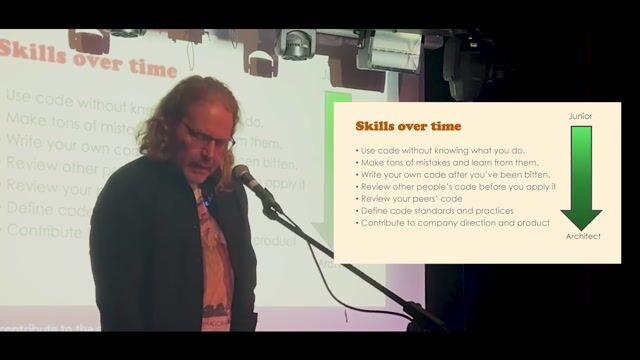

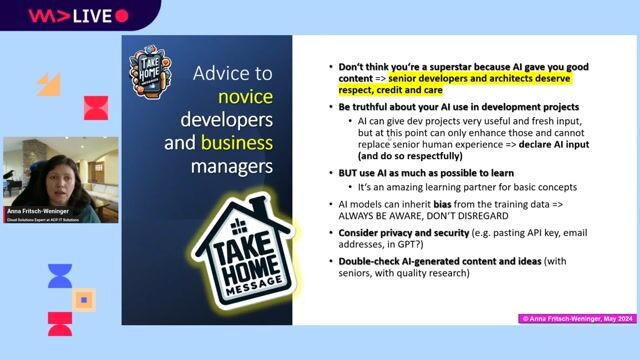

- Promote the adoption of best practices within research teams.

Requirements

Do you have experience in Python?, Do you have a Master's degree?, * A Master's degree in a relevant field (e.g., Computer Science, Engineering).

-

Ideally 7+ years of professional experience.

-

Solid experience as a quantitative developer in a financial institution.

-

Strong skills in Python and scientific libraries such as Pandas, NumPy, and Scikit-learn.

-

Ability to manage multiple tasks, work effectively in a team, and thrive in a dynamic environment.

-

Excellent communication skills in both French and English.