Senior IT Service Manager

Role details

Job location

Tech stack

Job description

Discover a career in your hands at HMRC. Whether you're seeking purpose, growth, or a workplace that gives you a true sense of belonging, hear from some of our employees as they share their story about what its really like to work at HMRC., This role will primarily involve the Service Management of IT Services alongside managing a multi-functional team that oversees the governance of identities and access management on the HMRC estate. This includes the planning of activities to ensure the delivery of successful Service Management, along with service performance, operational reporting, managing risks and problem solving., * Planning activities to ensure the delivery of successful Service Management.

- Service performance and operational reporting.

- Managing risks and problem solving.

- Working with stakeholders to transition new services into Business as Usual (BAU) live support and deliver changes.

- Representing the IT service managers at a senior level and acting as an escalation point for business stakeholders.

- Continually making improvements to IT processes and services.

- Improving user experience and increasing customer satisfaction., We want to make sure no one is put at a disadvantage during our recruitment process. To assist you with this, we will reduce or remove any barriers where possible and provide additional support where appropriate., HMRC has a presence in every region of the UK. For more information on where you might be working, review this information on our locations.

The Civil Service values honesty and integrity and expects all candidates to abide by these principles. The evidence you provide in your application must relate to your own experiences.

Any instances of plagiarism or other forms of cheating will be investigated and, if proven, the relevant application(s) will be withdrawn from the process.

Recording of interviews is prohibited unless explicit agreement is sought in line with the UK General Data Protection Regulations.

Questions relating to an individual application must be emailed as detailed later in this advert.

Applicants who are successful at interview will be, as part of pre-employment screening, subject to a check on the Internal Fraud Database (IFD). This check will provide information about employees who have been dismissed for fraud or dishonesty offences. This check also applies to employees who resign or otherwise leave before being dismissed for fraud or dishonesty had their employment continued. Any applicants details held on the IFD will be refused employment.

A candidate is not eligible to apply for a role within the Civil Service if the application is made within a 5 year period following a dismissal for carrying out internal fraud against government.

New entrants will join on the minimum of the pay band.

Please note that, if you are applying for roles on a part-time basis, the salary agreed will be pro-rata, reflective of the working hours agreed within your contract.

If you experience accessibility problems with any attachments on this advert, please contact the email address in the 'Contact point for applicants' section.

For more Information for people applying for, or thinking of applying for, roles at HM Revenue and Customs, please see link: Working for HMRC: information for applicants - GOV.UK. Feedback will only be provided if you attend an interview or assessment., * UK nationals

- nationals of the Republic of Ireland

- nationals of Commonwealth countries who have the right to work in the UK

- nationals of the EU, Switzerland, Norway, Iceland or Liechtenstein and family members of those nationalities with settled or pre-settled status under the European Union Settlement Scheme (EUSS)

- nationals of the EU, Switzerland, Norway, Iceland or Liechtenstein and family members of those nationalities who have made a valid application for settled or pre-settled status under the European Union Settlement Scheme (EUSS)

- individuals with limited leave to remain or indefinite leave to remain who were eligible to apply for EUSS on or before 31 December 2020

- Turkish nationals, and certain family members of Turkish nationals, who have accrued the right to work in the Civil Service, Appointment to the Civil Service is governed by the Civil Service Commissions Recruitment Principles. You have the right to complain if you feel there has been a breach of the Recruitment Principles. In the first instance, you should raise the matter directly via ubsrecruitmentcomplaints@hmrc.gov.uk. Please note that we do not accept complaints or appeals regarding scoring of outcomes of campaigns, unless candidates can provide clear evidence that the campaign did not follow the Recruitment Principles. If you are not satisfied with the response, you may bring your complaint to the Commission. For further information on bringing a complaint to the Civil Service Commission please visit their website.

Requirements

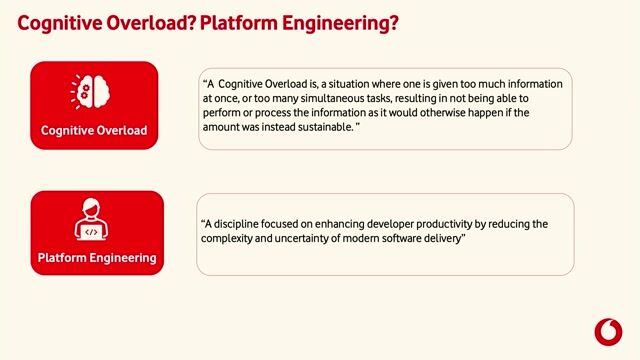

Do you have experience in Presentation skills?, * IT service delivery skills and an understanding of Microsoft Office 365.

- Excellent communication skills (verbal and written).

- Experience of collaborating with internal and external stakeholders/users/suppliers.

- Ability to learn quickly and master new concepts.

- Analytical skills.

Desirable Criteria:

- Understanding of successful delivery of end user IT services and continuous improvement.

- Understanding of ITIL processes.

- Commercial contract renewals and licensing of services.

- Problem solving., Customer facing roles in HMRC require the ability to converse at ease with members of the public and provide advice in accurate spoken English and/or Welsh where required. Where this is an essential requirement, this will be tested as part of the selection process., Successful candidates must undergo a criminal record check. People working with government assets must complete baseline personnel security standard (opens in new window) checks.

Benefits & conditions

Alongside your salary of £45,544, HM Revenue and Customs contributes £13,194 towards you being a member of the Civil Service Defined Benefit Pension scheme. Find out what benefits a Civil Service Pension provides.

HMRC operates both Flexible and Hybrid Working policies, allowing you to balance your work and personal commitments. We welcome applications from those who need to work a more flexible arrangement and will agree to requests where possible, considering our operational and customer service needs.

We offer a generous leave allowance, starting at 25 days and increasing by a day for every year of qualifying service up to a maximum of 30 days.

- Pension - We make contributions to our colleagues Alpha pension equal to at least 28.97% of their salary.

- Family friendly policies.

- Personal support.

- Coaching and development.