Data Analyst

Role details

Job location

Tech stack

Job description

Are you passionate about turning data into actionable insights? Join our Commercial Pricing Data Team at AXA, where you'll play a key role in shaping our strategic data landscape. Working closely with colleagues across different teams, you'll help build a robust, insightful, and accessible data environment that empowers our Pricing Analysts to make informed decisions. If you're eager to make a real impact through data and enjoy collaborative, innovative work, this could be the perfect opportunity for you.

At AXA we work smart, empowering our people to balance their time between home and the office in a way that works best for them, their team and our customers. You'll work at least two days a week (40%) away from home, moving to three days a week (60%) in the future. Away from home means either attendance at one of our office locations, visiting clients or attending industry events. We're also happy to consider flexible working arrangements, which you can discuss with Talent Acquisition.

What you'll be doing:

- Work with a variety of data tools and databases to design solutions, as well as maintaining, creating, updating, reading, and deleting data as needed.

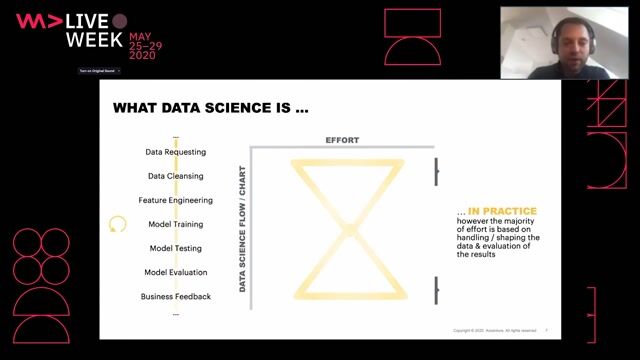

- Collect data from multiple sources, handling raw data, cleansing it, and converting it into structured formats suitable for further analysis and data science activities.

- Develop and maintain a business glossary and data dictionaries, and classifying data in accordance with local priorities.

- Collaborate with Data Architects, Data Protection Officers, and other stakeholders to implement data-by-design processes.

- Build expertise and capacity within the pricing team to enable self-service access to data from the data lake in the most efficient way.

- Create dynamic reports within Unity Catalog and Power BI.

- Eliminate outdated reports and processes and respond swiftly to provide the right data with ease, thereby supporting better pricing decisions and helping us stay ahead as a market leader., We acknowledge and appreciate the exceptional efforts of our people in protecting what matters most to our customers. In exchange we offer a series of core and supporting benefits designed to empower our people to thrive both professionally and personally., We believe in hiring people who possess the appropriate skills and values that align with our vision. Our selection process is fair and equitable, ensuring that all candidates have an equal opportunity to join us. We are dedicated to promoting diversity and inclusion, and we actively encourage applications from individuals of all backgrounds. As an Equal Opportunities Employer, we take pride in treating our employees and potential hires with respect and without discrimination based on any Protected Characteristics., AXA UK are recognised as a Disability Confident Leader. We actively encourage applications from people who face barriers in the workplace due to a disability or long-term health condition. We participate in the Disability Confident 'Offer of Interview' scheme. This means a fair and proportionate number of candidates with long-term health conditions or disabilities who meet the essential criteria of a job, will be offered an interview.

- You'll need to show you meet the essential criteria as detailed in the job advert or job description

- You don't need to share the details of your long term health condition or disability for your application to be considered under this scheme

As part of your application, you'll be asked if you would like to 'opt in'. To ensure ease of access, every job advert lists a responsible Talent Acquisition contact, who'll be able to connect you with our Accessibility Concierge if you require any support.

Screening & Conduct

As a regulated financial services company, all successful candidates will be subject to pre-employment checks. Additionally, adherence to the Prudential Regulation Authority's (PRA) Insurance Conduct Standards and the Financial Conduct Authority's (FCA) Conduct Rules will be required., This depends on the location of the role, and what works best for you and the interviewer. We'll give you all the information you need to prepare for whichever format's used for your interview.

I'm struggling to connect to my online interview, what should I do?

Don't worry, we know these things happen. Get in touch with the person who arranged your interview, or the Talent Acquisition contact. One of the team will be able to help get the interview started or re-arrange it for a different time.

How do I get feedback on my interview?

Whenever possible, we'll call and provide feedback by phone. Sometimes, we'll need to provide feedback by email.

How can I prepare for my interview?

We'll send a candidate preparation pack before the interview to help you prepare.

Requirements

- Proven experience with Python, PySpark, DevOps, and Unity Catalog.

- Demonstrated skills in extracting, manipulating, and reconciling data.

- Ability to work across structured, semi-structured, and unstructured data, extracting insights and identifying connections between disparate data sets.

- Solid understanding of information security principles to ensure data is handled and managed in a compliant manner.

- Excellent communication skills, with the ability to clearly explain complex solutions to diverse audiences.

- Understanding of the Commercial Insurance sector would be advantageous.

- Familiarity with Acturis would be advantageous.

As a precondition of employment for this role, you must be eligible and authorised to work in the United Kingdom.

Benefits & conditions

At AXA UK, we're appreciative of the people who work for us and our rewards package is reviewed regularly to reflect that. You can expect to receive:

- Competitive annual salary of up to £50,000 dependent on experience

- Annual company & performance-based bonus

- Contributory pension scheme (up to 12% employer contributions)

- Life Assurance (up to 10 x annual salary)

- Private medical cover

- 25 days annual leave plus Bank Holidays

- Opportunity to buy up to 5 extra days leave or sell up to 5 days leave

- Wellbeing services & resources

- AXA employee discounts, When will I hear back from you after my interview?

We aim to provide feedback as soon as the interview process allows. The time period will vary depending on the role.

How do I discuss the package I've been offered for a role?

You can discuss the package with your Talent Acquisition contact at offer stage.

Yay! I've got the role, what's next?

We'll carry out a number of background checks before you start. This is known as 'screening'.

Do you do any background checks?

Yes. All financial services companies, including AXA, are regulated by the Financial Conduct Authority (FCA). Being part of a regulated industry means we must check the background of all applicants before we confirm a job offer.

Pre-employment screening is not just regulatory, it also gives us the confidence that our people are the right fit to protect what matters to customers, colleagues, and our business.

- Who is screened? Everyone, from first-jobbers to senior directors! Often, the higher up the career ladder you are, the more stringent the screening becomes.

- What is screened? Identity and address; qualifications; employment history; credit check; criminal record; directorships.

If you think anything may affect these checks, please tell us.

What benefits or perks do you offer?

At AXA, we appreciate the people who work for us and regularly review our rewards package to reflect that. The advert for the role you're interested in will detail what you can expect to receive, but you can see an overview of our benefits and perks on our Why Join Us page.

Does AXA offer car allowance or a company car?

This depends on the grade, role, and eligibility of the employee. Check the benefits listed on the ad for the role you're interested in or confirm with your recruitment contact.