Anastasia Troitskaya

Microservices architecture as a key element in building trading systems for global finance markets

#1about 2 minutes

Introduction to building trading systems for global finance

An overview of the complexity of IT systems in investment banking and the key challenges in building a global trading platform.

#2about 3 minutes

Understanding the complexity of financial assets and products

Financial products like bonds, interest rate swaps, and credit default swaps have complex parameters that IT systems must handle correctly.

#3about 3 minutes

The ecosystem of market participants and trading venues

Trading involves external clients and bank dealers interacting across numerous electronic trading venues, each with unique interfaces and protocols.

#4about 2 minutes

Core architectural components and key system challenges

The architecture uses market connectors for venue-specific logic and an order management system for common tasks like validation and routing.

#5about 1 minute

The challenge of onboarding new trading venues efficiently

Onboarding a new venue involves many steps, and a non-scalable approach leads to hundreds of tech stacks and slow time-to-market.

#6about 1 minute

Ensuring trade settlement with preventive validation controls

The settlement process, where assets are transferred, can fail if trade data is incomplete, necessitating preventive controls to validate inquiries upfront.

#7about 3 minutes

A microservices approach to separate generic and specific logic

A scalable architecture separates venue-specific logic into market connectors while centralizing generic business logic like routing in a configurable framework.

#8about 3 minutes

Safely implementing new validation rules using a soft mode

New validation rules are rolled out in a non-blocking "soft mode" with monitoring to avoid disrupting high-volume workflows, supported by business analysts.

#9about 1 minute

Summary of architecture for scalable trading platforms

A recap of the platform structure, key challenges like venue onboarding and validation, and the architectural solutions that address them.

Related jobs

Jobs that call for the skills explored in this talk.

Matching moments

01:19 MIN

From fintech team building to architecture consulting

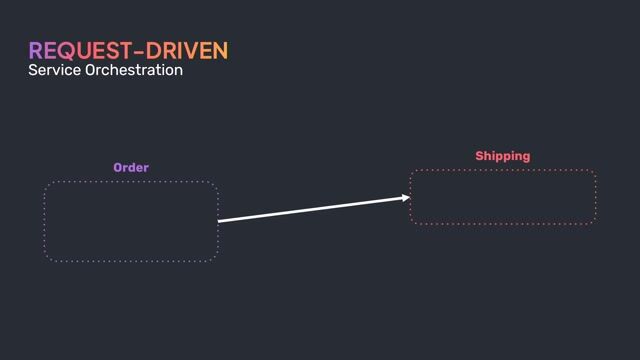

Event-Driven Microservices: Patterns and Practices - Lutz Heunkhen

03:03 MIN

An overview of the modern software architecture workshop

Mastering Modern Architecture - Oliver Sturm

04:03 MIN

The platform challenges of multi-cluster financial services

Monoskope: Developer Self-Service Across Clusters

02:53 MIN

Overview of a modern microservice architecture

Rapid Microservice Development with Project Templates

02:52 MIN

Improving operational efficiency for payments and trades

How to Build for Decentralized Systems

02:04 MIN

The challenge of monitoring at a global scale

Monitoring as Code - Managing your dashboards at scale

03:56 MIN

Making informed architectural trade-offs with standard protocols

Cloud Vendor Lock-In - Is it just a new version of the Database Abstraction Layers?

02:46 MIN

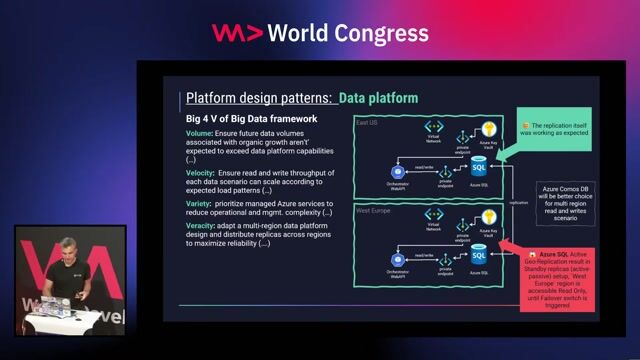

Understanding critical architectural trade-offs and anti-patterns

Azure-Well Architected Framework - designing mission critical workloads in practice

Featured Partners

Related Videos

27:19

27:19Modularity: Let's dig deeper

Pratishtha Pandey

24:25

24:25Autonomous microservices with event-driven architecture

Florian Lenz

50:06

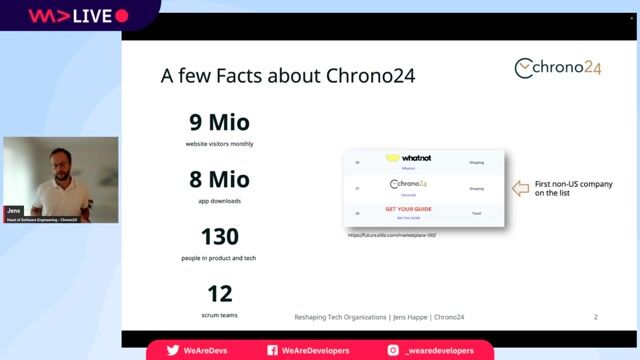

50:06Single Server, Global Reach: Running a Worldwide Marketplace on Bare Metal in a Cloud-Dominated World

Jens Happe

24:47

24:47Advanced Micro Frontends: Multi-Version and Multi-Framework Scenarios

Manfred Steyer

45:48

45:48Kafka Streams Microservices

Denis Washington & Olli Salonen

21:14

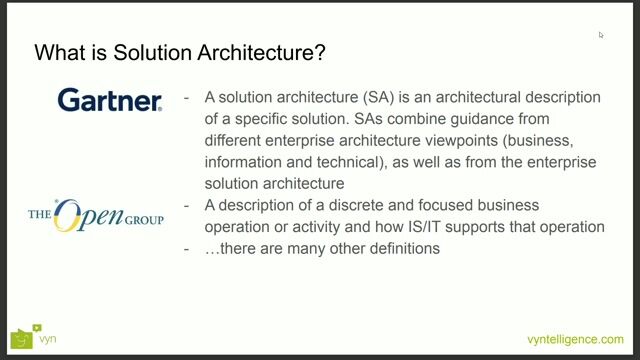

21:14Solution Architecture: A Startup Perspective

Andrey Semenyuk

21:19

21:19Next Level Enterprise Architecture: Modular, Flexible, Scalable, Multichannel and AI-Ready?

Maik Wietheger & Jan-Christoph Schlieker

25:05

25:05Microservices? Monoliths? An Annoying Discussion!

Eberhard Wolff

Related Articles

View all articles.gif?w=240&auto=compress,format)

From learning to earning

Jobs that call for the skills explored in this talk.

Deutsche Bank

Berlin, Germany

Senior

Java

Maven

DevOps

Gradle

Groovy

+13

ING

Amsterdam, Netherlands

Senior

Java

Solution Architecture

Business Process Management (BPM)

Digital Wave Finance

Zug, Switzerland

C++

Python

Scripting (Bash/Python/Go/Ruby)

Mondrian Alpha

Charing Cross, United Kingdom

Senior

Linux

Python

Scripting (Bash/Python/Go/Ruby)

SSW-Trading GmbH

Oststeinbek, Germany

Junior

Routing