Arik Shtilman

Fintech Rebellion: How Developers Are Disrupting the Future of Commerce

#1about 2 minutes

Software is eating the world and changing commerce

The digital commerce we see today is only the tip of the iceberg, as software continues to redefine jobs and industries.

#2about 2 minutes

The origin story and failure of CashDash

The initial attempt to build a consumer-facing digital wallet failed due to immense regulatory and compliance challenges in financial services.

#3about 2 minutes

Pivoting to create a fintech infrastructure platform

The company pivoted from a failed consumer app to building an API-first infrastructure platform, similar to AWS for cloud, to simplify global financial services.

#4about 3 minutes

Why every company is becoming a fintech company

Companies embed financial services to create customer stickiness, build direct relationships, and open new, recurring revenue streams.

#5about 4 minutes

How fintech powers modern gaming and marketplaces

Fintech infrastructure enables complex money movement behind the scenes for seamless user experiences in gaming, marketplaces like Uber, and e-commerce.

#6about 5 minutes

Using a single API for global payment methods

A fintech API can abstract the complexity of global commerce, allowing developers to accept local payment methods worldwide with a single integration.

#7about 3 minutes

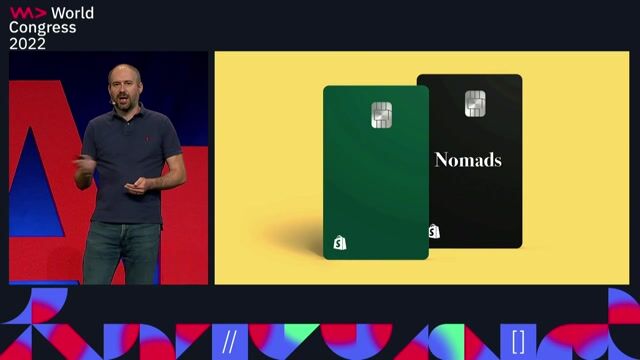

The rise of closed ecosystems and super apps

Major fintech trends include companies building closed ecosystems to retain funds and the evolution of super apps that embed payments and financial services.

#8about 3 minutes

Moving beyond ads to fintech-based monetization

The advertising-based revenue model is no longer viable for most apps, making embedded fintech the primary strategy for monetization and profitability.

#9about 4 minutes

Q&A on challenging SWIFT and the role of open banking

The speaker addresses the eventual replacement of legacy systems like SWIFT, the potential of open banking to accelerate innovation, and examples of government-led payment APIs.

#10about 2 minutes

Q&A on developer influence and entering the fintech field

Developers can drive fintech adoption by proposing new financial service ideas to leadership, and newcomers should start by learning the fundamentals of money movement.

Related jobs

Jobs that call for the skills explored in this talk.

Matching moments

06:43 MIN

Understanding the modern commerce technology stack

APIs and Architecture for scaling omnichannel payments

29:39 MIN

The future of payments and financial inclusion

The Developer Handbook: How to Build on the Blockchain

00:35 MIN

Introducing Money Bank and its engineering challenges

GitOps for the people

24:25 MIN

Enabling an ecosystem with Stripe Tax and Marketplace

Building Enduring Infrastructure: Lessons from the First 12 Years of Stripe

15:24 MIN

Defining the future of the modern developer role

The Evolving Landscape of Application Development: Insights from Three Years of Research

00:18 MIN

The evolving role of developers in the cloud era

Cloud Chaos and Microservices Mayhem

16:12 MIN

Strategies for building a new developer community

The Power of Developer Communities

42:00 MIN

The exciting future of developer tools and platforms

Transforming Software Development: The Role of AI and Developer Tools

Featured Partners

Related Videos

32:00

32:00Throwing off the burdens of scale in engineering

David Singleton & Thomas Pamminger

28:06

28:06Building Enduring Infrastructure: Lessons from the First 12 Years of Stripe

David Singleton

35:31

35:31How we will build the software of tomorrow

Thomas Dohmke

24:13

24:13Strategies to accelerate SaaS Application Development

Rajalakshmi Srinivasan

28:16

28:16Navigating the Corporate Jungle: Life as a Developer in a large Company

Alexandra Petri

48:35

48:35APIs and Architecture for scaling omnichannel payments

Ben Hartard

46:24

46:24The Rise of Reactive Microservices

David Leitner

28:45

28:45GitOps for the people

Lian Li

From learning to earning

Jobs that call for the skills explored in this talk.

Senior PHP Developer - Delft, NL

Online Payment Platform

Delft, Netherlands

€75-95K

Senior

PHP

MySQL

Laravel

Scrum Master - Fintech

Market Pay

Canton of Hérouville-Saint-Clair, France

Remote

JIRA

Scrum

Confluence

Agile Methodologies

Associate Software Engineer - Fintern Program

Finastra

Paris, France

Software Engineering Lead - Fintech

Client Server

Newcastle upon Tyne, United Kingdom

€100-150K

Senior

API

REST

DevOps

Python

+5

Software Developer (Backend) - Transform the future of business relationships

ZopaAI

Saarbrücken, Germany

Remote

JSON

REST

Django

Python

+3

Full Stack Engineer (Front-End Focus)- DeFi

Arrakis Finance

Zug, Switzerland

Remote

API

React

Figma

Node.js

+3