Product Manager - Indirect Tax Technology

Role details

Job location

Tech stack

Job description

As a Product Manager - VAT, you will shape and deliver product capabilities that support VAT determination, reporting, and compliance across multiple European markets. You will work closely with engineering, QA, design, regulatory specialists, and customer-facing teams to translate VAT regulatory requirements and client needs into high-quality product features.

This role suits someone who enjoys ownership, fast decision-making, and balancing regulatory accuracy with a strong user experience in an Agile environment.

What You Will Do

- Own the product roadmap for VAT functionality, covering both near-term delivery and longer-term strategy.

- Translate VAT regulatory requirements, customer feedback, and market insights into clear epics, user stories, and acceptance criteria.

- Lead sprint delivery: planning, backlog prioritisation, and progress tracking.

- Write structured, detailed Product Requirements Documents (PRDs).

- Partner with QA on bug triage, testing challenges, and release quality.

- Work closely with regulatory experts to ensure accuracy, compliance, and readiness ahead of legislative changes.

- Identify opportunities to improve VAT workflows, automation, and user experience.

- Collaborate with engineering to ensure clarity of scope, design, and technical approach.

- Support stakeholders-including support, implementation, and customer success-with VAT feature explanations.

- Contribute to pricing insights, competitive analysis, and win/loss reviews.

- Collaborate with global teams across time zones.

- Use AI tools to improve productivity, documentation quality, and decision-making., The tools to enhance your life - because we want you to enjoy your life outside of work and inside!

- An opportunity to work with a global team

- Bi-Weekly Meeting Free Days!

- Mentoring Programs

- Globally recognised Training and Development programs

- Benefits

Sovos is an equal opportunity employer committed to providing an environment that celebrates diversity and where equal employment opportunities are available to all applicants and employees. We do not discriminate against race, color, religions, national origin, age, sex, marital status, physical or mental disability, veteran status, gender identity, sexual orientation, or any other characteristic provided by law. At Sovos, all employees are encouraged to bring their whole selves to work.

Requirements

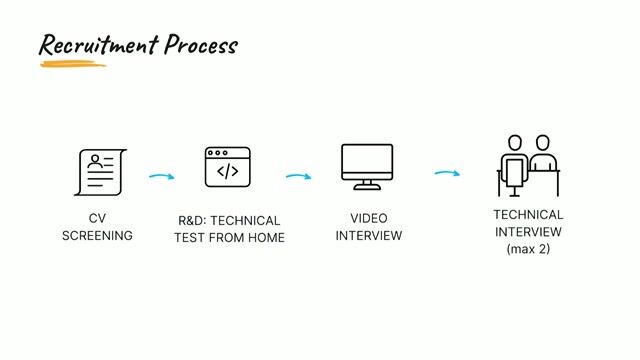

Do you have experience in Tax experience?, * 2+ years of product management, business analysis, or SaaS product development experience (senior candidates welcome).

- Experience with VAT, indirect tax, or regulatory/financial technology strongly preferred.

- Strong understanding of Agile processes, SDLC, and prioritisation frameworks.

- Ability to translate regulatory and technical topics into clear requirements.

- Proven experience creating PRDs and managing end-to-end sprint execution.

- Strong communication skills and ability to align cross-functional teams.

- Confident presenting product decisions to senior leaders and stakeholders.

- Curious, methodical, and committed to continuous learning.

- Ownership mindset with focus on value, outcomes, and releasing on time.

- Skilled with tools such as Jira, Confluence, and analytics platforms.

- Willingness to travel occasionally; must pass a background check.