Michiel Mulders

Tokenization of Everything: Where the Real World Meets Blockchain

#1about 4 minutes

What is tokenization and why is it useful

Tokenization creates digital representations of real-world assets to improve accessibility, liquidity, transparency, and reduce costs.

#2about 2 minutes

Use cases for tokenizing real-world assets

Practical examples of tokenization include stablecoins for cheap global transfers, gold for efficient trading, and fractionalized art for accessible investing.

#3about 3 minutes

Understanding synthetic versus backed asset tokens

Backed assets represent direct ownership of a real-world collateral, while synthetic assets only simulate an asset's value using algorithms.

#4about 6 minutes

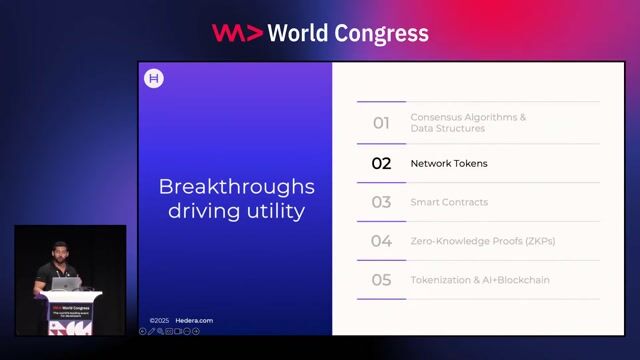

The core technical components for asset tokenization

Key technologies enabling tokenization include metadata standards for interoperability, oracles for secure data, proof of reserve for verification, and decentralized identities for trust.

#5about 1 minute

Real-world examples of tokenization on Hedera

Hedera enables tokenization for diverse assets like a $5 billion real estate portfolio with Swan and diamond trading with Diamond Standard.

Related jobs

Jobs that call for the skills explored in this talk.

Matching moments

22:49 MIN

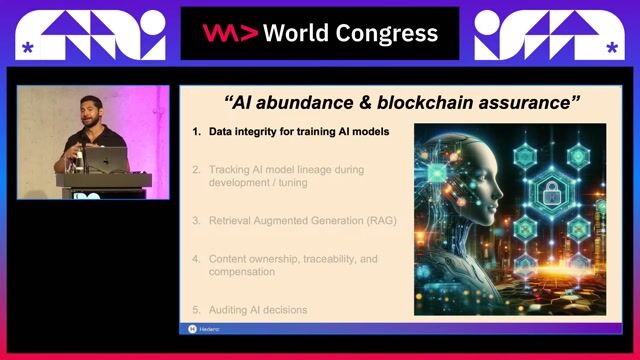

The future of assets with tokenization and AI

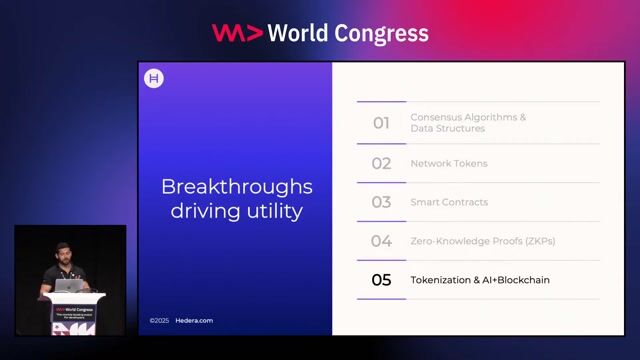

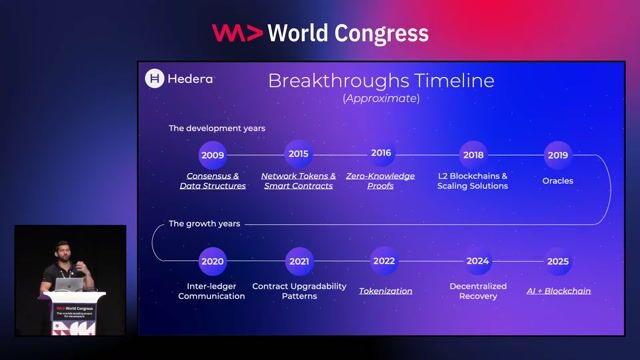

Demystifying Crypto & Web3: A Technical Journey Through 15 Years of Innovation

08:29 MIN

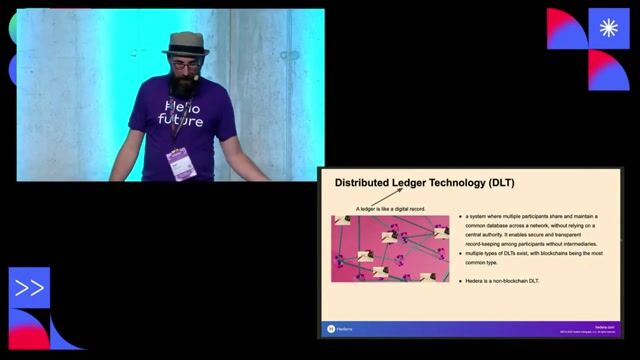

Exploring Hedera's unique approach as a DLT

A Primer on Blockchain and Hedera: An Intro Through Terms

25:41 MIN

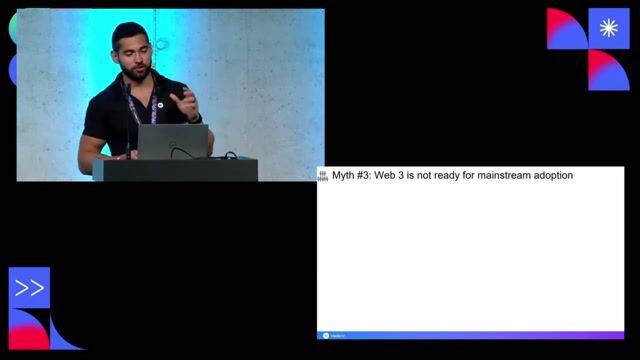

Examining the signs of mainstream Web3 adoption

Debunking the Top 10 Myths about Web 3

19:30 MIN

Exploring tokens, fungibility, and decentralized finance

A Primer on Blockchain and Hedera: An Intro Through Terms

47:25 MIN

Understanding fungible tokens (FTs) and NFTs

Blockchain, NFT and smart contracts for my application

25:54 MIN

Exploring real-world applications of distributed ledgers

Demystifying Crypto & Web3: A Technical Journey Through 15 Years of Innovation

12:23 MIN

The dual role of network tokens in Web3

Demystifying Crypto & Web3: A Technical Journey Through 15 Years of Innovation

52:28 MIN

Q&A on digital ownership, NFTs, and scalability

Blockchain, NFT and smart contracts for my application

Featured Partners

Related Videos

25:42

25:42Pragmatic Blockchain Design Patterns: Integrating Blockchain into Business Processes

Michiel Mulders

28:50

28:50Demystifying Crypto & Web3: A Technical Journey Through 15 Years of Innovation

Ed Marquez

30:11

30:11A Primer on Blockchain and Hedera: An Intro Through Terms

Ryan Arndt

49:10

49:10Build Real Things: Real-World Problems That Blockchain Actually Solves - Marco Podien

Chris Heilmann, Daniel Cranney & Marco Podien

57:38

57:38Blockchain, NFT and smart contracts for my application

Hendrik Ebbers

28:14

28:14Exploring 5 Key Applications of AI Abundance with Blockchain Assurance

ED MARQUEZ

31:07

31:07Blockchain Beyond Crypto: Technology Unlocking Opportunities across Various Industries

John Woods, Arthur Breitman & Vicktoria Klich

29:31

29:31Break the Chain: Decentralized solutions for today’s Web2.0 privacy problems

Adam Larter

From learning to earning

Jobs that call for the skills explored in this talk.

Domain Architect Ricardo Platform (f/m/d) | 80-100% | Hybrid working model | Valbonne France

SMG Swiss Marketplace Group

Canton de Valbonne, France

Senior

Blockchain Security Specialist (100% Remote)

Tether Operations Limited

Lugano, Switzerland

Remote

Intermediate

Ethereum

Solidity

Blockchain

Token Economics Analyst (Crypto / Blockchain)

Caizcoin

Frankfurt am Main, Germany

Remote

Intermediate

R

Python

Blockchain

Data analysis

System Engineer Blockchain - Self-Sovereign Identity (*)

Stolzberger GmbH

Berlin, Germany

Remote

Go

Java

Ethereum

JavaScript

+3

Data & Analytics - Blockchain Architect

Synergize Consulting Ltd

Kilsby, United Kingdom

Remote

Ethereum

Blockchain

Hyperledger

Data analysis

Technical Architect (100% Remote)

Tether Operations Limited

Charing Cross, United Kingdom

Remote

Senior

C++

JavaScript

AI Research Engineer - Reinforcement Learning (100% Remote)

Tether Operations Limited

Paris, France

Remote

PyTorch

Machine Learning

AI Research Engineer - Reinforcement Learning (100% Remote)

Tether Operations Limited

Zürich, Switzerland

Remote

PyTorch

Machine Learning