E-Invoicing Implementation Manager

Role details

Job location

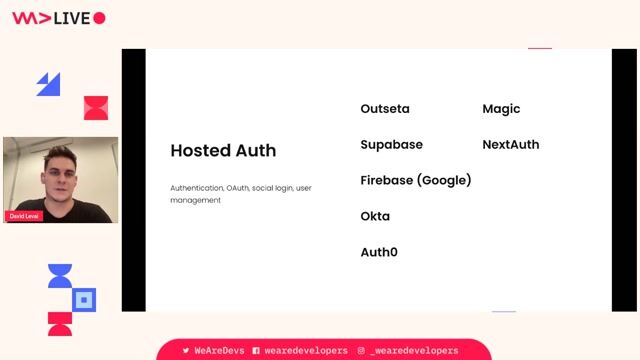

Tech stack

Job description

Are you ready to make a significant impact in the health and well-being sector? Our client, a global research-driven organisation dedicated to innovative solutions for unmet medical needs, is searching for an E-Invoicing Implementation Manager to join their dynamic Indirect Tax Team!

What You'll Do:In this pivotal role, you will lead the charge on key digital tax reporting projects across Europe, focusing on the technical implementation of E-invoicing and Standard Audit File - Tax (SAF-T) solutions. Collaborating with IT experts and local finance teams, you'll ensure that all data mapping and transformation meets local regulatory requirements., * Project Leadership: Serve as the primary tax project lead, bringing your technical expertise in E-invoicing and/or SAF-T implementation across various European jurisdictions.

- Requirements Definition: Translate complex local tax mandates into clear functional and technical requirements for system configuration.

- Data Mapping & Configuration:

-

- Lead comprehensive mapping of data fields from ERP systems (e.g., SAP, Oracle) to E-invoicing or SAF-T schemas.

-

- Configure and test data transformation rules within the chosen tax technology solution.

- System Integration: Work closely with IT and external technology vendors to ensure seamless integration between systems.

- Testing & Validation: Develop and execute detailed User Acceptance Testing (UAT) scripts to ensure compliance and accuracy.

- Documentation: Create and maintain essential documentation, including data flow diagrams and technical specifications.

- Stakeholder Management: Collaborate effectively with local finance/tax teams and external consultants across multiple countries.

Requirements

- Proven Track Record: Hands-on experience in end-to-end implementation of E-invoicing and SAF-T solutions.

- Technical Expertise: Deep understanding of data structures, schemas, and digital reporting requirements (e.g., XML, SAF-T).

- Tax Knowledge: Solid foundation in VAT principles and real-time reporting requirements.

- Project Management Skills: Ability to manage multiple workstreams and deliver results under tight deadlines.

- Work Style: A self-starter who is organised, detail-oriented, and comfortable working remotely in a flexible environment.

Desirable:

- Experience with E-invoicing mandates from countries like Italy and Romania.

- Background in SAF-T implementations in live environments (e.g., Poland, Denmark).

- Familiarity with dedicated Tax Engines (e.g., Vertex, Sovos).

Why Join Us?At our client, you'll be part of a collaborative environment where diverse perspectives drive innovation. They are committed to equal opportunity and celebrate the value of difference, making them a faster, smarter, and more innovative organisation.

If you're excited about leveraging your expertise to support impactful projects in the health and well-being sector, we want to hear from you!