Stefan Donsa & Lukas Alber

Detecting Money Laundering with AI

#1about 5 minutes

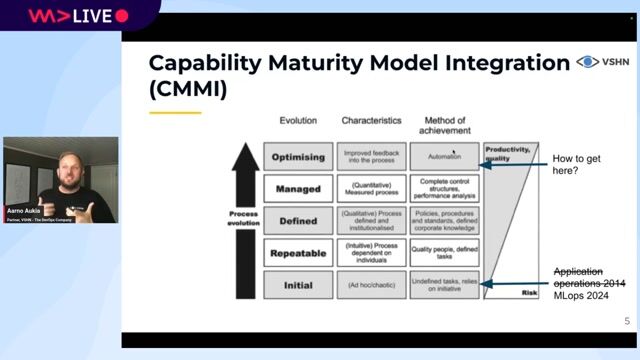

The lifecycle for operationalizing AI models in business

Moving beyond local development requires a structured lifecycle including ideation, proof of value, scaling, and continuous monitoring.

#2about 3 minutes

Understanding the limitations of rule-based AML systems

Traditional rule-based approaches for anti-money laundering suffer from high false-positive rates and fail to capture complex laundering patterns.

#3about 2 minutes

How AI improves AML and the challenges involved

AI can lower false positives and identify new threats, but success requires involving business experts and using explainable AI to build trust.

#4about 4 minutes

Using machine learning to detect KYC inconsistencies

Machine learning models analyze peer group behavior to identify outliers, such as a jobless person with high cash transactions, which rule-based systems miss.

#5about 5 minutes

A four-step process for unsupervised outlier detection

The process involves selecting relevant features, creating a master data table, using dimensionality reduction to find outliers, and scoring customers by reconstruction error.

#6about 3 minutes

Comparing PCA and autoencoders for anomaly detection

Principal Component Analysis (PCA) uses linear transformations while autoencoders use non-linear transformations for dimensionality reduction and reconstruction.

#7about 2 minutes

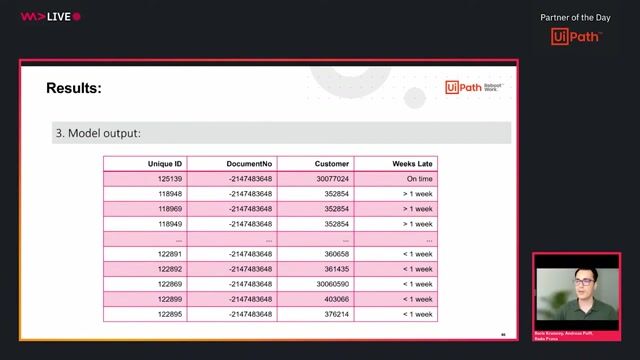

Validating the model's effectiveness with real-world results

The unsupervised models successfully identified over 100 suspicious cases, with one-third being new discoveries not caught by the existing rule-based engine.

#8about 3 minutes

The production architecture and technology stack for AML AI

The end-to-end system uses Hadoop for the data mart, PySpark for transformation, and Python with scikit-learn and MLflow for model development.

#9about 1 minute

Key takeaways for implementing AI in financial compliance

AI enhances AML efforts by detecting novel patterns, focusing agents on high-risk alerts, and providing transparent results to build trust with regulators.

Related jobs

Jobs that call for the skills explored in this talk.

msg

Ismaning, Germany

Intermediate

Senior

Data analysis

Cloud (AWS/Google/Azure)

WALTER GROUP

Wiener Neudorf, Austria

Intermediate

Senior

Python

Data Vizualization

+1

Matching moments

05:30 MIN

Implementing a two-step fraud detection solution

Unleashing the power of AI to prevent financial crime

05:01 MIN

Using AI to combat financial crime at ING

Unleashing the power of AI to prevent financial crime

20:14 MIN

Demonstrating an AI-powered cash collection application

Intelligent Automation using Machine Learning

05:17 MIN

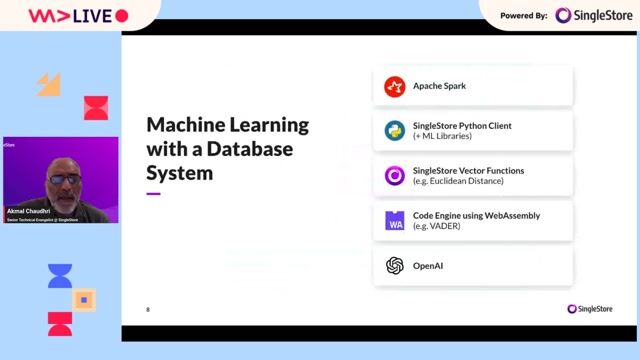

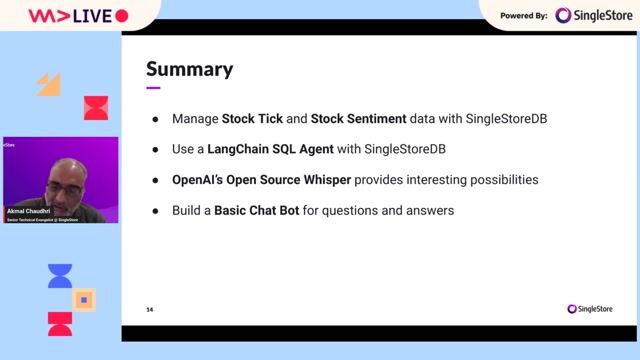

Applying AI and database technology in FinTech

OpenAI for FinTech: Building a Stock Market Advisor Chatbot

04:16 MIN

Applying supervised machine learning to pipeline data

Data Science, ML & AI in the Oil and Gas Industry at NDT Global - Dr. Katja Träumner

10:29 MIN

Exploring the future of AI in FinTech

OpenAI for FinTech: Building a Stock Market Advisor Chatbot

04:56 MIN

The critical role of real-time data in modern applications

Leveraging Real time data in FSIs

03:19 MIN

The overlooked security risks of AI and LLMs

WeAreDevelopers LIVE - Chrome for Sale? Comet - the upcoming perplexity browser Stealing and leaking

Featured Partners

Related Videos

29:40

29:40Unleashing the power of AI to prevent financial crime

22:06

22:06Anomaly Detection - Using unsupervised Machine Learning for detecting anomalies in customer base

Lukas Kölbl

34:21

34:21DevOps for AI: running LLMs in production with Kubernetes and KubeFlow

Aarno Aukia

57:46

57:46Overview of Machine Learning in Python

Adrian Schmitt

23:50

23:50Data Privacy in LLMs: Challenges and Best Practices

Aditi Godbole

48:07

48:07Is my AI alive but brain-dead? How monitoring can tell you if your machine learning stack is still performing

Lina Weichbrodt

58:00

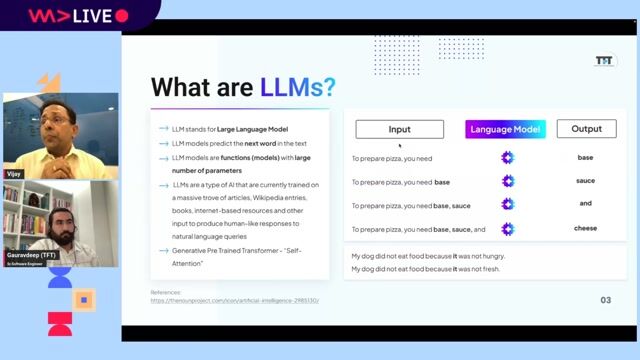

58:00Creating Industry ready solutions with LLM Models

Vijay Krishan Gupta & Gauravdeep Singh Lotey

30:49

30:49AI beyond the code: Master your organisational AI implementation.

Marin Niehues

Related Articles

View all articles

From learning to earning

Jobs that call for the skills explored in this talk.

Picnic Technologies B.V.

Amsterdam, Netherlands

Intermediate

Senior

Python

Machine Learning

Structured Query Language (SQL)

dmrz

Düsseldorf, Germany

API

.NET

DevOps

Python

Microservices

+2

Artificial Labs Ltd

Charing Cross, United Kingdom

Python

PyTorch

TensorFlow

Machine Learning

Randstad UK

Sheffield, United Kingdom

£91-104K

API

Azure

DevOps

Python

+4

AILY LABS

Barcelona, Spain

Data analysis

Machine Learning

Ernst & Young GmbH

Berlin, Germany

DevOps

Machine Learning